Introduction:

Artificial Intelligence (AI) is transforming all aspects of business activity amidst an era of digital transformation, and at the heart of it is finance. Companies are no longer using antiquated spreadsheets or consuming time with manual data entry, they are now using intelligent automation tools that provide speed, accuracy, and compliance. From payroll processed in seconds to automatic resolution of Stripe disputes, the following 6 AI financial automation tools redefine how companies deal with money.

The Future of Financial Automation: In-Depth Guide to 6 AI Tools Transforming Payroll, Invoicing, and Compliance

🔹 1. Payroll Robot

Category: Payroll Automation & Compliance

Tagline: “Automate pay 100% faster, smarter, and error-free.”

What It Does:

Payroll Robot automates end-to-end payroll processing and continuously monitors compliance regulations to ensure payments are processed as error-free as possible. Payroll Robot is built for accuracy, efficiency, and peace of mind when it comes to legal compliance.

Key Features:

- Automates salary payments by departments

- Continuously compares your payroll processing in real-time against local ceremonial and tax laws

- Built-in error detection engine can flag outliers in response to payments or records

- Payroll Employee Data for Taxes, Benefits, Bonuses, and Deductions

- Audit-ready payroll reports for stakeholders and legal purposes

Benefits:

- Hundreds of processing hours saved, which can be freed up to focus on your people strategy to grow and develop your people talent

- Can minimize the legal implications of non-compliance

- Easily scalable as your teams grow and change

Ideal Use Cases:

- SMEs scaling activity across multiple states or countries

- HR departments where fewer actions support the available time

- Startups with complex contractor payments

-

FinDaily

Category: Automation for Financial Reporting and Digestion

Tagline: “Get personalized financial digests via email and API.”

What it does:

FinDaily’s goal is to assist business leaders with unaware financial updates with AI personalized financial summaries via secure email. It uses your existing financial systems via API.

Key Features:

– API integration with accounting systems, accounting platforms, and CRMs

– Digest pieces are driven by desired KPIs and trends

– Ability to create the email delivery (daily/weekly/monthly)

– Summarize reports with natural language summaries to support better decisions.

Benefits:

– Reduces dashboard fatigue—delivers only what you need

– Saves time pulling data for manual reporting

– Keeps teams aligned with consistency by staying aware

Target Use Cases:

– Executives who wanted to be informed daily/weekly on their financials

– Accountants VR managing client portfolios and projects

– CFO’s and financial advisors

-

Receptor AI

Category: Email Invoice Extraction & Classification

Tagline: “Extract and manage documents and invoices all from one email provider.”

What It Does:

Receptors scans your inbox for documents, invoices, and receipts, separates and sorts them into easily identifiable bookkeeping categories.

Key features:

- Inbox scanning of receipts and invoices (e.g., Gmail, Outlook)

- AI-based text extraction from any PDF, image, or email body

- Smart classification of receipts into sections such as tax deductible, pending, and paid

- Integrates into accounting systems like QuickBooks and Xero

Benefits:

- Reduced lost invoices and late payments

- A full automation of the process, so no endings without action on collecting broker documentation

- Increase the accuracy of financial records in the case of an audit

Ideal Use Cases:

- Freelancers and consultants with dozens of dollars in receipts

- E-commerce businesses with as many or more email orders

- All accountants process expense claims

-

GetInvoice

Category: Invoice Tracking & Management

Tagline: “Never lose an invoice again.”

What It Does:

GetInvoice is an invoice management system that connects to your Gmail and pulls invoices in so that you will be able to manage all of your invoices in one dashboard.

Key Features:

• Multiple Gmail account connections

• Auto-pull the details of invoices (amount, due date, sender, etc.)

• History/archive of invoices that are searchable

• Dashboard to show due date, paid/unpaid usage

Benefits:

• One site for all invoices, teams, and departments

• Ends late payments or double entry points

• Ease of preparation in tax season/ expense audit

Ideal Use Cases:

• Small businesses managing multiple vendors

• Start-ups receive all invoices via email

• Remote teams where there is no clarity in tracking invoices

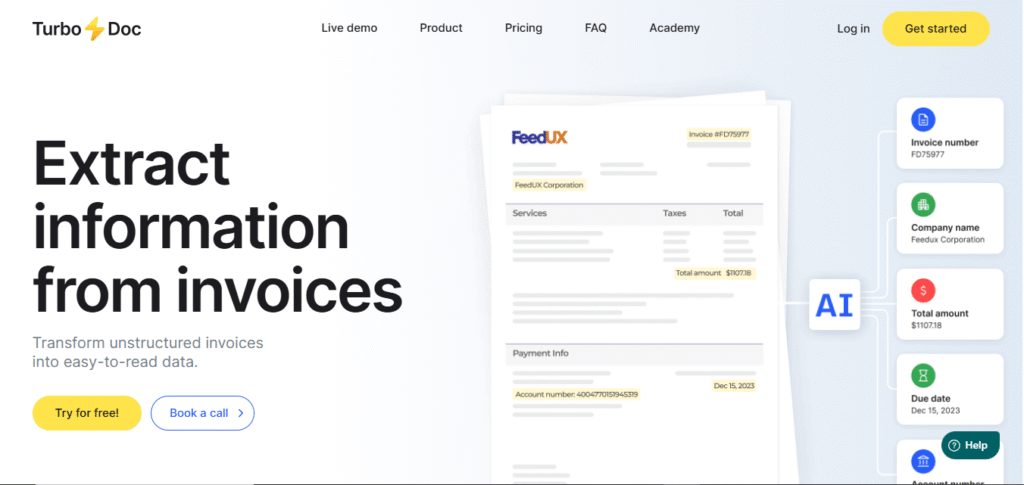

🔷 5. TurboDoc

Category: AI Document Management for Businesses

Tagline: “Automate different types of financial documents in simpler and faster ways.”

What it does:

TurboDoc uses AI to drive documentation on autopilot mode, supporting especially financial documentation. It now extracts the data from any invoice, docs, receipts, or financial documentation and pipelines that data into your systems.

Key features:

- Intelligent data extraction for invoices, buy orders, and bank statements

- AI-enabled field detection (e.g., due dates, amounts, company name)

- Document to database mapping for docs

- Compliance tagging and storage of digital records

Benefits:

- Reduction in manual entry and errors

- Elimination of wasted time in invoice reconciliation

- Better compliance with a searchable record

Use cases:

- The finance department processes thousands of documents per month

- Logistics firms processing documents from suppliers

- Firms looking to scale processing documents and compliance.

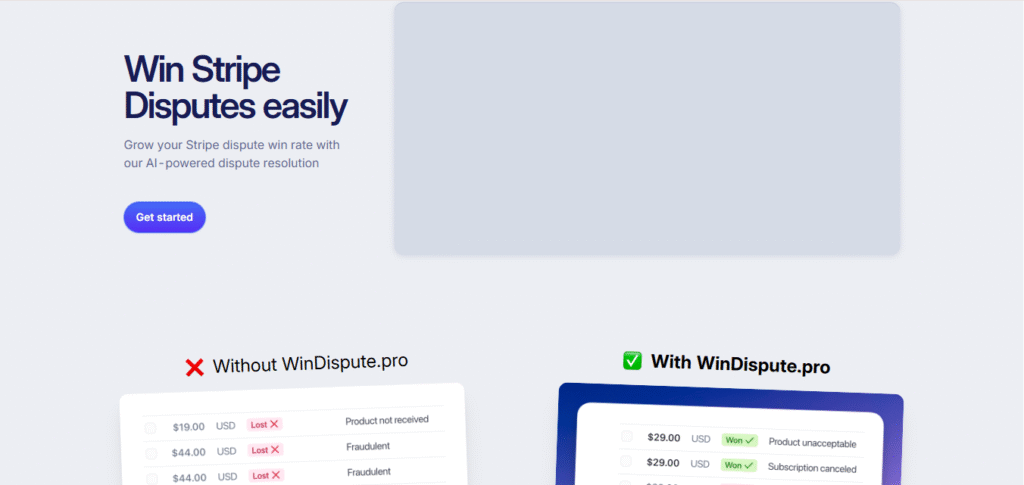

🔹 6. WinDispute.pro

Category: Stripe Dispute Resolution Automation

Tagline: “Win Stripe disputes with AI-powered responses.”

What It Does:

WinDispute.pro automates your payment disputes on Stripe. It helps you quickly create data-backed rebuttals that will give you the best chance of winning chargebacks and simplifies your process.

Key Features:

- Instant setup with Stripe

- Real-time dispute detection

- Auto-response packet generation (there are three core offerings — customer data, transaction log, emails)

- Submission to the Stripe platform

Benefits:

- Increases the success rate for winning disputes

- Protects your revenue with less time spent on the manual dispute process

- Gives support for Stripe TOS compliance with organized responses

Best Use Cases:

- SaaS companies leveraging Recurring Payments

- Online merchants transacting high volumes through Stripe

- Customer support teams are involved with refund requests

🧠 Final Insights: Why These Tools Matter

These AI tools aren’t just nice-to-have—they’re becoming essential infrastructure in the digital finance stack. Here’s why:

| Tool | Problem Solved | Business Impact |

| Payroll Robot | Payroll errors and legal non-compliance | Faster payroll + reduced legal risk |

| FinDaily | Overwhelming dashboards and manual reporting | Personalized, digestible updates |

| Receptor AI | Lost receipts and invoice chaos in inboxes | Automatic extraction and categorization |

| GetInvoice | Lack of visibility on invoices | Organized, searchable, and timely invoicing |

| TurboDoc | Manual data entry and document errors | AI accuracy with scalable document handling |

| WinDispute.pro | Time-consuming and unsuccessful Stripe disputes | High win rate and faster resolution |

🚀 The Future Is Automated

At scale, the intricacies of financial happenings become rapid. Whether you’re a freelancer who needs to track receipts or an enterprise that manages thousands of invoices monthly, these tools help you become smarter in organizing and remaining compliant while remaining cash-flow-positive. AI is not only automation, but it is a full-on boost to your intelligence, speed, and control of the influx of money.

🤔 Frequently Asked Questions (FAQS)

Q1. Can I run multiple tools on top of each other?

Yes! For example, you can use Receptor AI to aggregate invoice emails, TurboDoc to intelligently process them, and FinDaily to summarize them for you daily.

Q2. Are these tools secure?

Overall, a large number of these tools use OAuth and encryption as well as GDPR compliant provisions. Still, you should always check their data policies before moving forward with connecting sensitive accounts.

Q3. Do I need technical skills to use any of these tools?

No. These tools are developed for non-technical users and usually have simple UIs and guided steps through the setup process.

Q4. Which tool is best suited for freelancers?

- Use FinDaily for financial summaries

- Receptor AI or GetInvoice for collecting invoices and receipts

Q5. What if I am using Outlook, not Gmail?

Tools such as Receptor AI are likely working on expanding their support to Outlook. For now, GetInvoice is predominantly Gmail-based.